Assessment

During this stage, on the basis of a furnished checklist, we will assess the scope and define the cost of a Legal Due Diligence.

Preparatory stage

During the preparatory stage, our specialists or participants of the selling company will prepare documents required for the due diligence.

Main stage

During the main stage, REVERA’s lawyers will check all furnished documents, assess risks and prepare the final report. The final report will indicate all detected violations and other flaws, evaluate the consequences and provide recommendations on remedial actions.

Concluding stage

The concluding stage involves presentation of the final report to client, discussion of potential risks and decision-making on further monitoring of the project: remedial actions or debugging control, preparation for purchasing a share, or refusal to purchase.

Projects

Kek Entertainment

REVERA's team of lawyers provided comprehensive legal support to GameDev studio Kek Entertainment in raising a second round of investment from South Korean venture fund Korea Investment Partners and their co-investors Woori Technology Investment Co., Kona Venture Partners, The Games Fund and Play Ventures.

Made On Earth Games

The REVERA team provided legal support for seed round of investment in Made On Earth Games, in which the lead investor was GEM Capital, with participation of US investment fund The Games Fund, as well as Raga Partners and Heracles Capital.

Buying a manufacturer of an ethnic street food

REVERA conducted Due Diligence of the target company on corporate and commercial issues in the interests of the investor. After Due Diligence, the lawyers prepared all necessary documents for the subsequent purchase of the company.

Dalkacom

Comprehensive support during preparation for the M&A transaction included Due Diligence as well as option issues and corporate procedures.

Epic Star

Comprehensive support during preparation for the M&A transaction included Due Diligence and sanctions compliance, as well as option issues and corporate procedures.

Marketing platform-aggregator of requests

REVERA conducted a comprehensive Due Diligence of the company before the transaction, which covered such aspects as corporate history, commercial relationships and contracts, GDPR compliance, labour issues and IP. This resulted in recommendations to mitigate the identified risks.

Articles

M&A Guide for the IT Sector

announcements

announcements

WN Conference Istanbul’25: Two Days of Real Connections, Industry Insights & Smart Deals

news

news

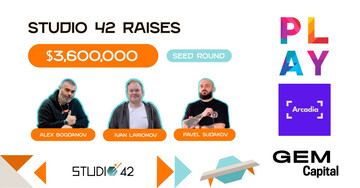

REVERA law group advises Studio42 on a €3.6 million funding round

news

news

REVERA recognised in the Legal500 international rankings!

events

events

27 March — Legal Café REVERA in Limassol

announcements

announcements

Video. Legal changes in 2024 and trends for 2025